how to file taxes for coinbase

Coinbase Tax Resource Center. Check out our frequently asked questions found within the Coinbase Taxes Summary section for more information.

Forbes Tech On Twitter Bitcoin Cryptocurrency Trading Bitcoin Mining

Raw transaction report If you or your CPA are up for the challenge of manually calculating gains you can use your raw transaction report to reconcile all of your gains and losses before filing your taxes.

. Coinbase Pro Tax Reporting. Coinbase Tax Reporting. Use the Coinbase tax report API with crypto tax software.

There are some limitations though. Yes youll need to report your cryptocurrency capital gains and losses on your taxes because even if you do not Coinbase does report your crypto activity to the IRS if you meet certain criteria you should be a Coinbase customer. You can generate your gains losses and income tax reports from your Coinbase Pro investing activity by connecting your account with CoinLedger.

Toda actividad de trading conlleva riesgos. Ad Crea compra y puja en NFTs de creadores de todo el mundo. Esto no es una asesoría de inversión.

Log in to your Coinbase Pro account and select your profile in the top right then statements. How to File Coinbase Pro Taxes. This includes currency awarded through Coinbase Earn Staking or USDC Rewards.

Theres a couple of ways to get your Coinbase Pro transaction history -download it from your account as a file or automate this with the Coinbase Pro API. Coinbase announced that it will begin issuing form 1099-MISC to certain users for the 2020 tax year replacing the old 1099-K forms that have created major tax headaches for investors. Join our Cryptocurrency Newsletter for tutorials and cutting Edge topicshttpschicvoyageckpagec5218e0a60You may need to download your transactions for t.

Taxes can be taxing. All you need to do with a crypto tax app is add your Coinbase Pro API keys or upload your Coinbase Pro CSV files and let your crypto tax calculator do the rest. This tax season Coinbase customers will be able to generate a GainLoss Report that details capital gains or losses using a HIFO highest in first out cost basis specification strategy.

How to file crypto taxes for dogecoin. CELSIUS FREE 50 WORTH OF BTC httpscelsiusnetworkapplink106166e241. From your Ledgible Tax account select the Exchanges tab.

Login using your TurboTax credentials and complete your tax return plus Coinbase customers get up to 20 off After your tax refund has been calculated TurboTax will ask you to enter account details to receive your refund. Connect your account by importing your data through the method discussed below. Non-US customers wont receive any forms from.

Itll calculate your crypto taxes and generate a custom tax report based on your location and tax office or even specific reports for your chosen tax app. You also have to complete transactions in cryptocurrency trading on the platform in the previous year equal to or exceeding 600 worth. This entire video will walk you through what you generally need to do to file your crypto taxes correctly.

Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations. This video really focuses on how crypto taxes work on coinbase but the process could be. In order to receive Form 1099 you have to be an account-holder on Coinbase in the US or US tax-compliant areas.

ROBINHOOD Get 1 Free Stock. COINBASE FREE 50 WORTH OF BTC. Coinbase Pro CSV exports.

You can only upload a maximum of 1000 transactions into Turbo Tax and the gains loss calculator will not include any transactions that were on Coinbase Pro. Esto no es una asesoría de inversión. Ad Crea compra y puja en NFTs de creadores de todo el mundo.

You can also find more on our support hub here. Begin filing your taxes from the Coinbase section of the TurboTax website. You can generate your gains losses and income tax reports from your Coinbase investing activity by connecting your account with CoinLedger.

Here is a step by step guide of how to file Coinbase Pro taxes with Ledgible. You can download a CSV file of your Coinbase Pro transaction history. Should have earned 600 or more in rewards or fees from Coinbase Earn USDC Rewards andor Staking.

A US person for tax purposes. Toda actividad de trading conlleva riesgos. You need to download your transaction history from the Coinbase website and use them to upload into TurboTax.

Coinbase Pro exports a complete Transaction History file to all users. If you use Coinbase you can sign in and download your gainloss report using Coinbase Taxes for your records or upload it right into TurboTax whenever youre ready to file. Then you can either upload this to a crypto tax app or do your Coinbase Pro yourself.

This report is designed to help taxpayers quickly and easily understand their gains or losses for the tax year using our calculations. Connect your account by importing your data through the method discussed below. How to file crypto taxes for Ethereum.

The new tax center simplifies this process by using the initial value of a customers crypto and then showing taxable activity over time by realized gainslosses. How to get Tax Form from Coinbase download your tax forms Coinbase - httpbitlyCoinbaseSPATHBuySell 100 worth of Crypto to receive 10 in BitcoinT. Navigate to your Coinbase account and find the option for downloading your complete transaction history.

Coinbase Learn How To Set Up A Crypto Wallet Youtube In 2022 Learning Wallet Setup

Wealthsimple Smart Investing Investing Money Money Saving Strategies Money Strategy

Coinbase Users Will Be Able To File Tax Reports By The Coin Tracker Service In 2021 Filing Taxes Bitcoin Account Coins

Newsflash The Price Of Bitcoin Drops Nearly 12600 Amid Fears Of Trade Bans In South Korea Bitcoin Bitcoin Price Coin Market

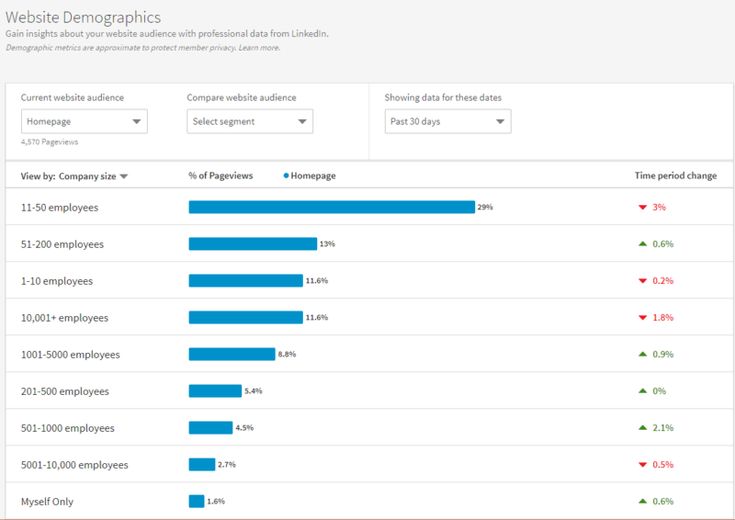

How To Make The Most Of The Demographics Of Linkedin S Free Website Free Website Demographics Business Website

Coinbase Users Will Be Able To File Tax Reports By The Coin Tracker Service In 2021 Filing Taxes Bitcoin Account Coins

What Cryptocurrency Has To Do With The Video Card Shortage Cryptocurrency Bitcoin Price Bitcoin

Coinbase Insta A Sus Usuarios A Pagar Impuestos Sobre Ganancias En Bitcoin Filing Taxes Income Tax Tax Brackets

Cartesi Is Now On Coinbase Earn Earnings Cryptocurrency News Bitcoin Currency

Cryptocurrency Tax Tips Until Tax Relief Passes Expert Blog Crypto News Bitcoin Regulation Coinbase Cryptocurrency Cryptocurrency News Bitcoin Mining Software

Forex Trading Bitcoin Bitcoinrts Irs Stymied Over American Cryptocurrency Traders Reluctance To Bit Ly 2vifqaf Bit Ly 2hfro8g Ekonomi Para Yatirim

Product Hunt Launches Digestion Application Of New Techniques Without Spam Sip Digestion Product Launch Application

Newsflash The Price Of Bitcoin Drops Nearly 12600 Amid Fears Of Trade Bans In South Korea Bitcoin Bitcoin Price Coin Market

Pin On Small To Medium Business

Coinbase Est Desormais Votre Guide Personnalise Des Taxes Cryptographiques Par Coinbase Janvier En 2022 Personnalise Chef De Produit Investir En Bourse